All Categories

Featured

Table of Contents

- – Unparalleled Accredited Investor Property Inve...

- – Accredited Investor Investment Returns

- – Best Accredited Investor Funding Opportunitie...

- – Best Accredited Investor Alternative Investme...

- – Market-Leading Accredited Investor Opportuni...

- – Expert High Yield Investment Opportunities F...

- – High-End Accredited Investor Wealth-building...

The laws for certified capitalists differ among territories. In the U.S, the meaning of a certified investor is put forth by the SEC in Policy 501 of Policy D. To be a certified capitalist, an individual should have an annual earnings going beyond $200,000 ($300,000 for joint earnings) for the last two years with the assumption of gaining the same or a higher earnings in the current year.

This quantity can not include a main house., executive policemans, or directors of a firm that is releasing non listed protections.

Unparalleled Accredited Investor Property Investment Deals

Additionally, if an entity contains equity owners that are certified investors, the entity itself is a recognized financier. A company can not be developed with the single objective of buying specific protections. An individual can qualify as a certified financier by showing sufficient education or work experience in the financial industry

Individuals that want to be approved financiers do not apply to the SEC for the classification. Rather, it is the responsibility of the business offering a personal positioning to make certain that every one of those come close to are approved financiers. People or celebrations who want to be certified financiers can approach the company of the unregistered protections.

Expect there is an individual whose income was $150,000 for the last three years. They reported a main house worth of $1 million (with a home mortgage of $200,000), a cars and truck worth $100,000 (with an impressive finance of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Total assets is calculated as assets minus liabilities. This person's web well worth is precisely $1 million. This includes a computation of their possessions (apart from their main house) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan equaling $50,000. Given that they satisfy the total assets need, they qualify to be a certified financier.

Accredited Investor Investment Returns

There are a few much less common qualifications, such as taking care of a depend on with greater than $5 million in possessions. Under federal protections laws, just those who are certified financiers may take part in particular securities offerings. These may include shares in exclusive positionings, structured items, and private equity or hedge funds, amongst others.

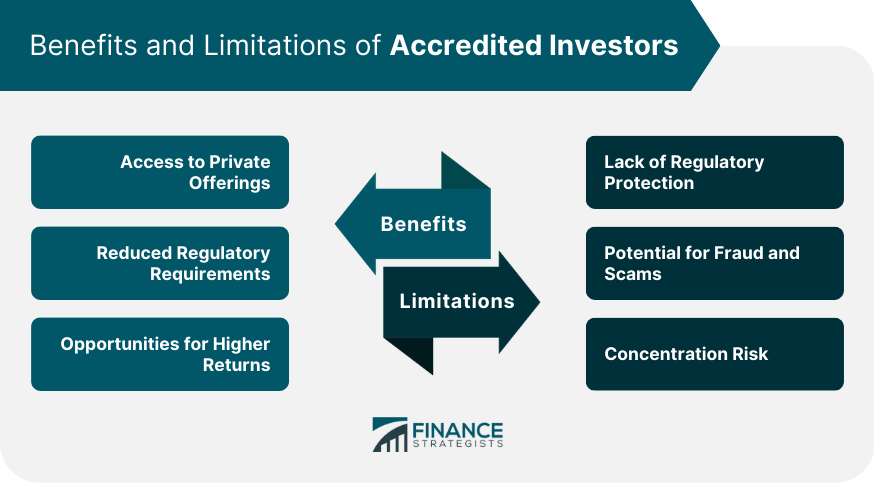

The regulatory authorities wish to be certain that individuals in these very risky and complex financial investments can take care of themselves and evaluate the threats in the lack of federal government defense. The certified capitalist regulations are developed to protect prospective capitalists with limited monetary expertise from risky ventures and losses they may be sick equipped to stand up to.

Certified capitalists fulfill certifications and specialist criteria to accessibility unique investment chances. Designated by the U.S. Securities and Exchange Payment (SEC), they acquire entry to high-return alternatives such as hedge funds, financial backing, and private equity. These financial investments bypass full SEC registration but lug higher threats. Recognized investors should satisfy earnings and total assets requirements, unlike non-accredited individuals, and can invest without limitations.

Best Accredited Investor Funding Opportunities for Financial Freedom

Some vital changes made in 2020 by the SEC consist of:. This adjustment recognizes that these entity kinds are usually utilized for making investments.

These modifications increase the certified financier pool by approximately 64 million Americans. This bigger access provides much more chances for investors, yet also increases potential risks as less economically advanced, capitalists can participate.

These financial investment alternatives are exclusive to recognized capitalists and institutions that certify as a recognized, per SEC guidelines. This offers certified capitalists the opportunity to spend in arising companies at a phase before they think about going public.

Best Accredited Investor Alternative Investment Deals

They are deemed financial investments and come only, to qualified customers. In addition to recognized companies, qualified financiers can pick to purchase startups and up-and-coming endeavors. This provides them tax obligation returns and the opportunity to go into at an earlier phase and possibly gain rewards if the business succeeds.

For capitalists open to the dangers entailed, backing start-ups can lead to gains (accredited investor wealth-building opportunities). A number of today's technology companies such as Facebook, Uber and Airbnb stemmed as early-stage startups sustained by recognized angel investors. Advanced investors have the opportunity to explore financial investment options that might yield a lot more revenues than what public markets supply

Market-Leading Accredited Investor Opportunities

Although returns are not ensured, diversification and profile improvement options are increased for capitalists. By expanding their profiles via these increased investment methods recognized financiers can boost their methods and potentially achieve superior long-lasting returns with correct danger monitoring. Seasoned financiers usually run into financial investment choices that might not be quickly offered to the basic investor.

Investment options and safeties used to accredited capitalists normally include higher dangers. Personal equity, endeavor funding and hedge funds commonly concentrate on investing in possessions that bring risk but can be sold off easily for the opportunity of higher returns on those risky investments. Looking into prior to investing is crucial these in situations.

Lock up periods stop investors from withdrawing funds for even more months and years on end. Financiers may struggle to precisely value personal properties.

Expert High Yield Investment Opportunities For Accredited Investors with Accredited Investor Support

This change may expand accredited investor condition to a series of people. Updating the earnings and possession standards for rising cost of living to ensure they mirror modifications as time proceeds. The present thresholds have remained fixed because 1982. Permitting partners in dedicated relationships to integrate their sources for common qualification as certified investors.

Allowing individuals with specific specialist accreditations, such as Collection 7 or CFA, to qualify as recognized capitalists. Producing additional demands such as proof of financial literacy or effectively completing an accredited investor test.

On the other hand, it might additionally result in experienced investors assuming extreme threats that may not be ideal for them. Existing recognized investors might deal with boosted competition for the best investment chances if the swimming pool expands.

High-End Accredited Investor Wealth-building Opportunities

Those that are currently thought about accredited capitalists need to remain updated on any kind of alterations to the standards and guidelines. Services looking for recognized capitalists should stay watchful about these updates to ensure they are attracting the ideal target market of financiers.

Table of Contents

- – Unparalleled Accredited Investor Property Inve...

- – Accredited Investor Investment Returns

- – Best Accredited Investor Funding Opportunitie...

- – Best Accredited Investor Alternative Investme...

- – Market-Leading Accredited Investor Opportuni...

- – Expert High Yield Investment Opportunities F...

- – High-End Accredited Investor Wealth-building...

Latest Posts

Tax Foreclosure Ny

Houses With Back Taxes For Sale

Foreclosure Tax Sale

More

Latest Posts

Tax Foreclosure Ny

Houses With Back Taxes For Sale

Foreclosure Tax Sale