All Categories

Featured

Table of Contents

- – Groundbreaking Passive Income For Accredited I...

- – All-In-One Accredited Investor Financial Growt...

- – Private Equity For Accredited Investors

- – Dependable Accredited Investor Investment Fun...

- – Reputable Accredited Investor Investment Funds

- – Trusted Accredited Investor Alternative Asse...

- – Acclaimed Accredited Investor Syndication Deals

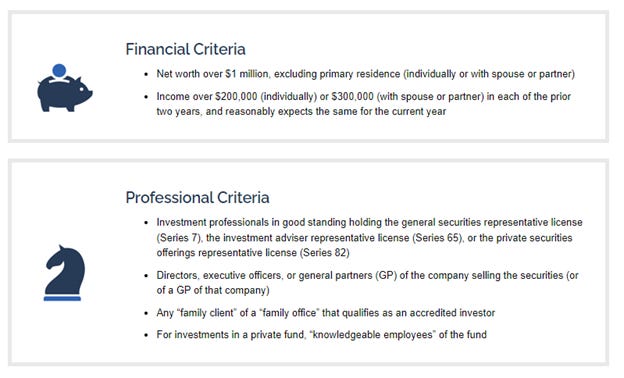

The guidelines for recognized investors differ among jurisdictions. In the U.S, the interpretation of a recognized investor is presented by the SEC in Regulation 501 of Regulation D. To be a certified financier, an individual has to have a yearly revenue going beyond $200,000 ($300,000 for joint income) for the last 2 years with the expectation of making the very same or a greater earnings in the existing year.

An approved capitalist ought to have a total assets going beyond $1 million, either individually or collectively with a partner. This quantity can not include a key house. The SEC also takes into consideration applicants to be certified investors if they are basic companions, executive policemans, or supervisors of a company that is issuing non listed safeties.

Groundbreaking Passive Income For Accredited Investors

If an entity is composed of equity owners that are approved investors, the entity itself is a recognized investor. A company can not be developed with the single objective of acquiring certain safeties. A person can qualify as an accredited capitalist by showing adequate education and learning or job experience in the monetary market

Individuals who intend to be certified investors do not put on the SEC for the classification. Rather, it is the obligation of the firm using a personal positioning to see to it that all of those approached are approved capitalists. Individuals or celebrations that intend to be recognized capitalists can approach the provider of the non listed protections.

Expect there is an individual whose income was $150,000 for the last 3 years. They reported a key home value of $1 million (with a mortgage of $200,000), an automobile worth $100,000 (with an outstanding funding of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

This individual's web well worth is specifically $1 million. Because they satisfy the internet well worth need, they certify to be a recognized capitalist.

All-In-One Accredited Investor Financial Growth Opportunities

There are a couple of less common qualifications, such as handling a depend on with more than $5 million in properties. Under government protections laws, only those that are accredited capitalists may join specific safety and securities offerings. These may consist of shares in personal positionings, structured items, and private equity or hedge funds, to name a few.

The regulatory authorities want to be certain that individuals in these very risky and complicated financial investments can fend for themselves and evaluate the dangers in the lack of government defense. The accredited financier regulations are created to secure potential financiers with restricted financial expertise from high-risk endeavors and losses they might be ill geared up to stand up to.

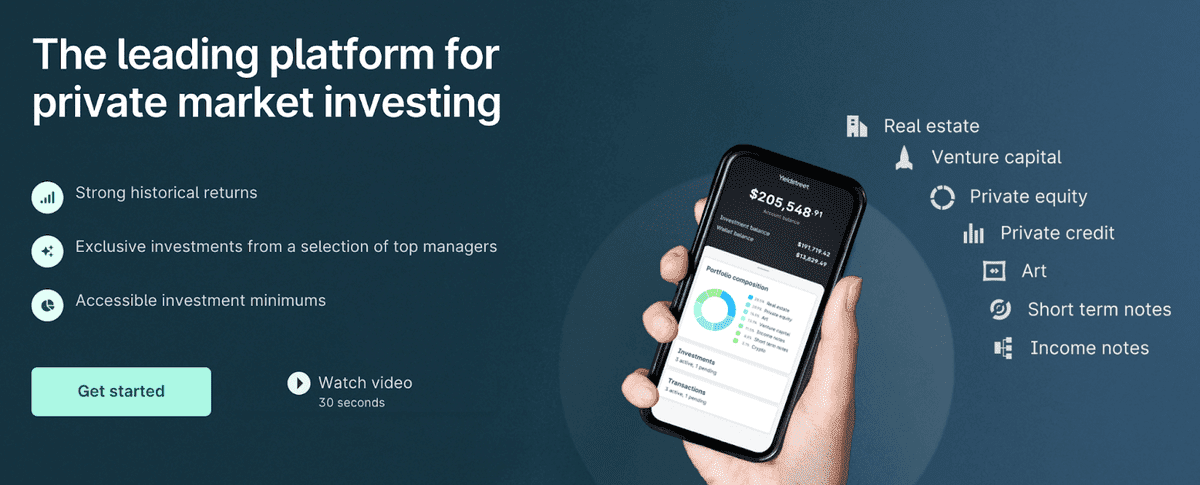

Certified investors satisfy qualifications and specialist standards to gain access to exclusive financial investment opportunities. Designated by the U.S. Securities and Exchange Commission (SEC), they acquire access to high-return alternatives such as hedge funds, financial backing, and exclusive equity. These financial investments bypass full SEC enrollment however lug greater threats. Accredited financiers should fulfill revenue and net well worth requirements, unlike non-accredited people, and can invest without restrictions.

Private Equity For Accredited Investors

Some key adjustments made in 2020 by the SEC consist of:. Including the Series 7 Collection 65, and Collection 82 licenses or other qualifications that reveal economic competence. This modification recognizes that these entity types are typically utilized for making investments. This change recognizes the competence that these staff members develop.

These changes expand the recognized investor pool by approximately 64 million Americans. This wider access provides more opportunities for investors, but likewise boosts prospective dangers as much less economically advanced, investors can participate.

These financial investment choices are exclusive to recognized capitalists and institutions that qualify as an approved, per SEC laws. This offers certified investors the chance to invest in emerging business at a stage before they consider going public.

Dependable Accredited Investor Investment Funds for Accredited Investor Wealth Building

They are watched as financial investments and are available only, to qualified customers. Along with recognized business, qualified investors can pick to buy startups and promising ventures. This uses them income tax return and the opportunity to go into at an earlier stage and possibly reap incentives if the business thrives.

For investors open to the threats involved, backing startups can lead to gains (accredited investor platforms). Much of today's technology business such as Facebook, Uber and Airbnb originated as early-stage start-ups sustained by approved angel investors. Advanced investors have the chance to check out financial investment options that might produce a lot more profits than what public markets offer

Reputable Accredited Investor Investment Funds

Returns are not ensured, diversification and portfolio improvement alternatives are expanded for investors. By expanding their portfolios via these broadened investment opportunities recognized capitalists can improve their approaches and potentially achieve remarkable long-term returns with correct risk administration. Seasoned capitalists often encounter investment options that might not be easily readily available to the general financier.

Financial investment choices and securities supplied to recognized investors typically entail greater risks. Personal equity, venture funding and hedge funds typically concentrate on spending in possessions that bring threat but can be sold off quickly for the opportunity of higher returns on those high-risk financial investments. Looking into before spending is important these in scenarios.

Lock up periods avoid capitalists from taking out funds for even more months and years at a time. There is likewise much much less transparency and regulatory oversight of private funds contrasted to public markets. Investors may battle to properly value private possessions. When taking care of risks certified capitalists require to evaluate any kind of private investments and the fund managers entailed.

Trusted Accredited Investor Alternative Asset Investments for Secured Investments

This modification might expand accredited investor standing to an array of people. Allowing companions in dedicated partnerships to combine their sources for common qualification as recognized financiers.

Making it possible for people with specific professional accreditations, such as Collection 7 or CFA, to qualify as recognized capitalists. This would identify financial sophistication. Producing additional needs such as evidence of economic proficiency or effectively finishing an approved investor test. This can ensure capitalists comprehend the threats. Restricting or getting rid of the key residence from the total assets computation to reduce potentially inflated evaluations of wide range.

On the other hand, it can additionally result in seasoned capitalists presuming too much dangers that may not appropriate for them. Safeguards may be needed. Existing certified financiers may deal with raised competition for the best investment chances if the pool expands. Firms raising funds might gain from an increased recognized financier base to attract from.

Acclaimed Accredited Investor Syndication Deals

Those that are presently thought about accredited investors have to stay updated on any kind of alterations to the standards and guidelines. Their qualification might be subject to adjustments in the future. To preserve their standing as recognized financiers under a changed definition modifications might be needed in wealth monitoring techniques. Services looking for recognized investors should stay alert concerning these updates to guarantee they are bring in the ideal target market of investors.

Table of Contents

- – Groundbreaking Passive Income For Accredited I...

- – All-In-One Accredited Investor Financial Growt...

- – Private Equity For Accredited Investors

- – Dependable Accredited Investor Investment Fun...

- – Reputable Accredited Investor Investment Funds

- – Trusted Accredited Investor Alternative Asse...

- – Acclaimed Accredited Investor Syndication Deals

Latest Posts

Tax Foreclosure Ny

Houses With Back Taxes For Sale

Foreclosure Tax Sale

More

Latest Posts

Tax Foreclosure Ny

Houses With Back Taxes For Sale

Foreclosure Tax Sale